Sudden $8.6 Billion Bitcoin Move May Be Largest Crypto Heist — Incoming Market Crash?

Suspected $8.6 Billion Bitcoin Move Sparks Fears of Largest Crypto Heist

Summary: A dormant stash of 80,000 Bitcoin, valued at over $8.6 billion, was unexpectedly transferred to new wallets, triggering speculation of a potential crypto heist. Industry voices, including Coinbase executive Conor Grogan, point to signs of possible foul play, raising concerns about market implications.

Background: Dormant Wallets Reactivate After 14 Years

On July 4, blockchain analytics platform Arkham Intelligence reported that 80,000 BTC were moved from wallets untouched since 2011. These assets were distributed evenly across eight new wallets, raising eyebrows within the crypto community. The original deposits had remained dormant for over 14 years, suggesting a long-lost or carefully stored Bitcoin trove had suddenly been accessed.

While market watchers are accustomed to large ‘whale’ transactions, the origins and timing of this shift are unusual—especially given current volatility in BTC prices. Notably, none of the transfers involved exchange-linked wallets, offering some relief as it implies there’s no immediate threat of a sell-off. However, the sheer scale and sudden reactivation have stirred widespread speculation and concern.

Heist or Legitimate Move? Industry Weighs In

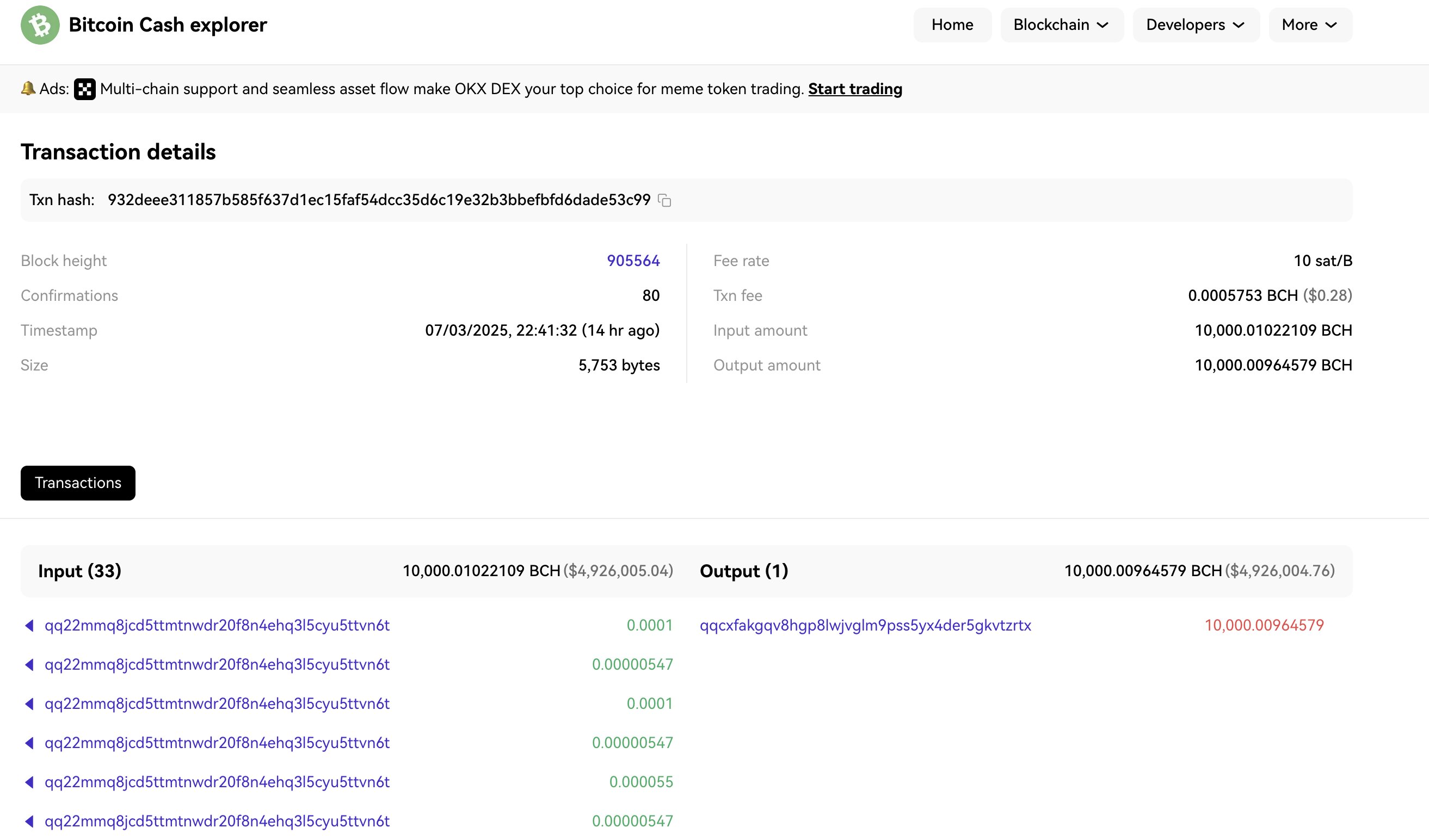

Conor Grogan, Head of Product at Coinbase, took to social platform X to voice concerns that the coordinated transfers may signal a significant crypto theft. His theory is based on a 10,000 BCH (roughly $4.9 million) transaction, traced to a related wallet cluster just 14 hours prior to the large Bitcoin movements. Grogan suggests this could have been a test to confirm control over stolen private keys.

According to Grogan, the manual nature of the BTC movements—rather than automated or exchange-initiated transfers—could indicate that bad actors secured access to the funds. Nevertheless, he labels his own theory as “extreme speculation,” acknowledging the possibility that the actual wallet owner may be behind the activity.

Meanwhile, other analysts have pushed back against the heist narrative. A crypto commentator going by the X handle “binji” argued that the staggered, cautious transfers suggest a ‘handshake transaction’ rather than a hack, pointing to the lack of typical urgency seen in theft scenarios.

Market Impact and Community Reaction

While fears of a major sell-off loomed, the fact that the Bitcoin was not moved to exchanges has tempered immediate panic. Still, the movements have reignited conversations around dormant wallets, private key security, and potential vulnerabilities in legacy holdings. The crypto community remains split between theories of a targeted theft and legitimate re-engagement by a long-term holder.

Bitcoin Price Update

At the time of writing, Bitcoin trades at $108,150, reflecting a daily decline of 1.06%. Despite the recent dip, BTC continues to show resilience over longer time frames, posting weekly and monthly gains of 0.98% and 2.78%, respectively.