Top Multi-Strategy Hedge Funds for Maximum Returns

Multi-Strategy hedge funds are aimed at making the losses smaller and smaller with a collective investment plan. Users don’t just bet on one stock here but juggle them up with a whole list of investment strategies to keep the plan going. In this case, even if the market gets low, the profit is still maintained and at least does not hit rock bottom.

These funds are the rock stars of the hedge fund world as they are pulling in billions from big players who want returns and are not happy with the single-strategy crash.

In this article, we shall discuss the multi-strategy hedge funds, their expected advantages, why they’re so popular, and where they’re headed in this high-stakes game.

What Are Multi-Strategy Hedge Funds?

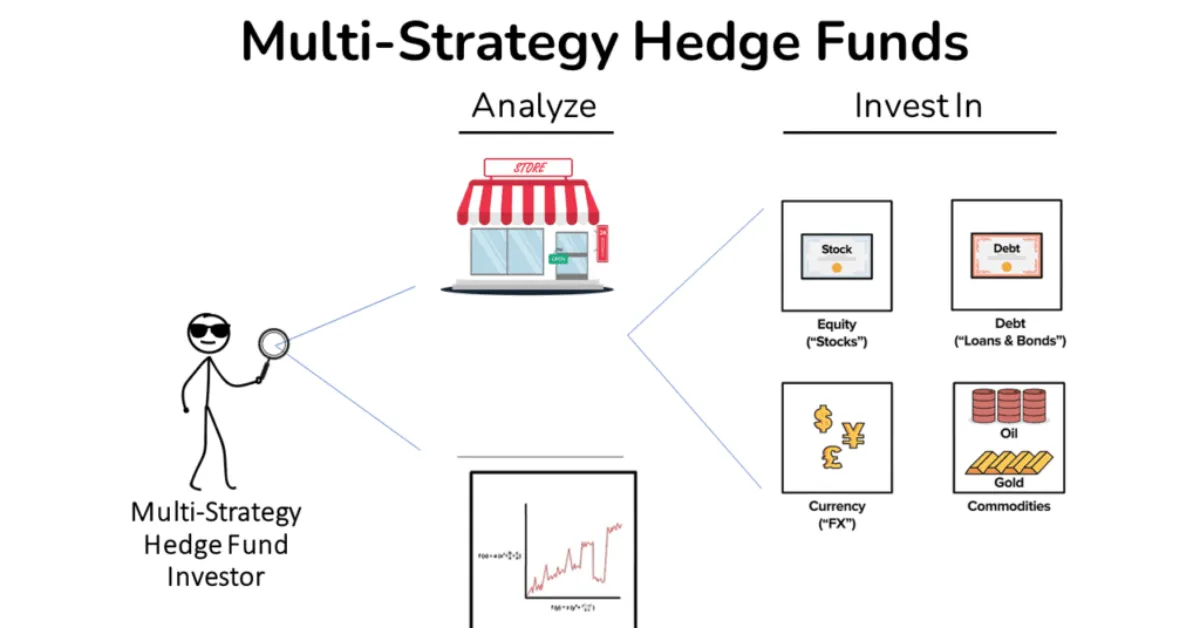

Many users just assume that hedge funds are all about one big bet that covers stocks, bonds, or some similar big name, but it comes as a surprise that Multi-strategy funds are actually much simpler than that.

They’re like a financial menu served in buffet style. They are piling a bit of everything onto your plate. These funds present together different investment approaches, including equity long or short, global macro, and such offers.

They have everything covered to accommodate all your preferences. Also, they shift money between these investments very smoothly without putting you through any struggle.

Here is a quick recap of what exactly these hedge funds are-

- Mix of all: They play everything from equity long or short, where you can buy cheap stocks, to event-driven and global macro approaches.

- Quick Shifts: These funds allow managers to act like DJs. They can remix capital to produce the best-performing strategies at any given moment.

- Risk Management: Spreading bets across strategies is very profitable and keeps your investment safe and sound.

- Pro Teams: Each strategy gets its own team of experts, so you don’t worry about the biases.

How They Came to Rule the Best?

Multi-strategy hedge funds were born as a remedy to the earlier market failures that would cause single-strategy funds to go down to some cheap prices. These hedge funds are led by heavyweights like Citadel and Millennium Management. These firms built a name and a reputation by hiring the sharpest minds and giving them the freedom to chase opportunities across markets. These are driving over $50 billion each in 2025, so that’s a big win.

Strategies for Hedge Funds

Running a multi-strategy fund is very much similar to cooking a meal with a dozen ingredients, and each ingredient should be at an optimal level. Each strategy brings its own flavour, and the best funds know how to mix them for maximum impact. Some of these ingredients are:

- Equity Long or Short: Buying stocks that you think will flourish in future.

- Event-Driven: Putting cash on corporate expected events like mergers, bankruptcies, or spinoffs.

- Global Macro: Betting on big-picture shifts, like currency shifts or interest rate increases.

- Fixed-Income Arbitrage: Spotting tiny price gaps in bonds and turning them into gold.

- Quant Tricks: Using algorithms to compile data and trade faster than a regular caffeine-sustained day trader.

- Credit Gambles: Going with corporate debt or distressed bonds for high-risk.

- Commodities and Volatility: Trading oil, gold, or market mood swings.

What Are The Benefits of Multi-Strategy Hedge Funds?

Multi-Strategy Hedge funds are like a financial safety net that is spreading risk across strategies, so you’re not left high and dry when markets tank. They’re made to keep your returns steady and safe.

- Risk Spreader: They do avoid the kind of market tanking sink single-strategy funds by spreading it across multiple levels.

- Smooth Going: Shifting capital to hot strategies keeps the returns coming.

- Star Power: You’re getting access to the best of finance.

- Risk Manager: Offers focused oversight and tech to keep potential disasters at a distance.

What Are The Risks Associated With Multi-Strategy Hedge Funds?

It can never be all roses and sunshine with financial markets, so there are obvious risks attached to hedge funds as well. The complexity that comes with such blended strategies can prompt the costs and risks at a much higher level. It can keep even the sharpest managers up at night.

- Operational Problems: Coordinating teams and strategies is a logistical nightmare that demands the best systems.

- Wallet Burn: Fees can be high, like 2% of assets plus 20% of profits, as the talent and tech don’t come cheap.

- Correlation Traps: Sometimes, when the situation is tough, the strategies that seemed independent can move together.

- Ego Fights: Portfolio managers might play tug-of-war as they keep prioritising their own wins over the fund’s.

- Liquidity Snags: Some bets, like distressed debt, can be hard to unload when investors want out.

- Regulatory Headaches: New rules in the U.S. and Europe mean more paperwork and higher costs.

Performance and Market Risks

Multi-strategy funds have a solid understanding of shining when the market gets hectic. Industry numbers peg their average returns at 6-8% a year over the last decade. They weathered the 2020 COVID depreciation and the 2022 inflation spike like winners to provide their customers the best of all waters.

- Crisis Crushers: These funds grow in volatility as they are a diversified playbook.

- Money Magnet: They’re going up by nearly 30% of hedge fund assets.

- Market Movers: Big names like Citadel can restore prices and liquidity in certain markets.

- Fee Fights: There are certain competitions that can push some funds to trim fees.

Tech Support by Multi Strategy Hedge Funds

Technology is the secret to these fund planning. The risk systems here can spot trouble faster than any human possibly can. It accommodates everything from AI to high-speed trading platforms.

- Risk Watchdog: Real-time systems track exposures and run stress tests to avoid meltdowns.

- Data Sorcery: Machine learning sifts through data to find market gems others miss.

- Lightning Trades: High-tech platforms execute trades across global markets in a blink.

- Smart Money Moves: Algorithms shuffle capital to strategies with the best shot at big wins.

Types of Multi-Strategy Hedge Funds

- Market-Focused Funds: These funds zero in on specific asset classes or regions. They might blend strategies like equity and event-driven, but keep their bets within a single market.

- Opportunistic Funds: These funds chase alpha funds wherever it hide, like treasure hunters with a map to every corner of the globe. They mix global macro, commodities, and arbitrage.

- Risk-Parity Funds: These funds balance risk across strategies to keep the portfolio steady.

- Quant-Driven Funds: These funds depend on algorithms and data compilation to power their strategies.

- Pod-Based Funds: Here, each “pod” is a team running its own strategy.

The Future of Hedge Funds

- Crowded Field: New funds are coming up, making hedge funds an exceptional choice for talent and capital.

- Green Push: Investors are clamouring for ESG strategies, so funds may need to rethink their game.

- Rule Tightrope: Stricter regulations could increase costs and limit some bets.

- Tech Leap: AI and quantum computing could take strategy execution to the next level.

- Client Demands: Investors want transparency, lower fees, and managers who play fair.

Conclusion

Multi-strategy hedge funds are the financial world’s master mind that blends a dozen strategies in the pot while also handling the market curveballs. They make you feel relaxed and secure with their spread of investment. They’re not perfect obviously, as they have a high fee demand, and complexity is a beast. Their ability to blend diverse approaches, tame risks, and deliver steady returns makes them a powerhouse. Get your investment game strong with the Multi-Strategy Hedge funds, and read the terms and conditions before you sign up with any of these .

Read also :