Crypto Swing Trading Strategy Explained: 5 Key Rules

Swing trading crypto is a smart way to make money when prices go up and down. Instead of trading every single day or holding coins for years, a crypto swing trading strategy is all about buying low and selling high over a few days or weeks. But to really do well, you need to follow a plan.

Let’s first understand what a crypto swing trading strategy is and how it works before we jump into the five simple rules.

What is Swing Trading In Crypto?

A crypto swing trading strategy means you buy crypto when the price is low and then sell it when the price goes up. This could take a few days or even a couple of weeks. You are not holding it forever, and you are not selling it on the same day either. It is kind of in the middle.

You try to catch the swing of the price, buy when it dips, and sell when it peaks. Most swing traders look at charts and patterns to decide when to buy or sell. Some people also check the news, but charts are usually more helpful because the news often comes too late.

Now, let us look at the 5 most important rules that can help you use a crypto swing trading strategy like a pro.

Rule 1: Trade Based on the Market’s Mood

The crypto market does not always go up or down in a straight line. Sometimes it is rising (bull market), sometimes it is falling (bear market), and other times it just goes sideways.

In a bull market: Try to buy the dip—when prices go down for a short time—and let your profits grow. Hold on to your coins a bit longer if the market keeps going up.

In a bear or sideways market: Don’t wait too long. Sell when you have made a little profit. You don’t want to lose your gains by holding too long.

One way to check if the market is going up or down is by using something called the 20-week moving average. It is a line on a chart that shows the average price over 20 weeks. If Bitcoin is above that line and the line is pointing up, it’s a bull market. If it is below and the line is going down, it is likely a bear or sideways market. This indicator can be very useful for your crypto swing trading strategy.

Rule 2: Don’t Buy Everything at Once

Let’s say you want to invest in a coin. Don’t buy it all in one shot. Instead, split your investment into 2 or 3 smaller parts. Buy a little now, and if the price drops more, buy some more.

This helps you get a better average price. It is called “buying in slowly,” and it can save you from losing a lot if the price falls right after you buy. This risk management is a key part of any crypto swing trading strategy.

Rule 3: Don’t Sell Everything at Once Either

If the price is going up and you are making money, that’s great! But do not sell it all right away. Sell a little bit at a time. That way, you get to lock in some profit while still holding on to more coins in case the price keeps rising.

This works really well in a bull market where coins often jump higher than expected. Gradual selling is a smart move in a crypto swing trading strategy.

Rule 4: Cut Your Losses Early

Sometimes your trade will not work out. That’s okay. What’s not okay is waiting too long to sell and letting a small loss turn into a big one.

Let’s say you lose 1% or 2%—you can recover from that easily. But if you wait too long and lose 10% or 20%, it is much harder to bounce back. It is better to admit your mistake early and move on to the next trade.

Also, remember Rule 2? Buying in small chunks helps here, too. You do not risk everything all at once, which keeps your losses smaller. Cutting losses early is vital to a successful crypto swing trading strategy.

Rule 5: Follow the Charts, Not the News

Most of the time, crypto prices move before big news hits the internet. That is because smart traders already guessed what was coming and acted early.

So instead of waiting for news articles or headlines, watch the price charts. They show you what’s really happening in the market. The charts are usually one step ahead, while the news is often too late to help you. Chart analysis is the backbone of any effective crypto swing trading strategy.

Swing Trading vs. Day Trading: What’s the Difference?

Both crypto swing trading strategy and day trading are ways to make money from crypto. But they are not the same. Here is how they are different:

- How Long You Hold: In a crypto swing trading strategy, you keep your trade open for a few days or weeks. In day trading, you buy and sell within the same day.

- How Often You Trade: Swing traders make fewer trades. Day traders trade a lot more.

- Stress Levels: Swing trading is usually more relaxed because you don’t have to make fast choices. Day trading is more stressful because you need to act quickly.

- Risk and Profit: Swing trades can bring bigger profits from one trade. Day traders try to make smaller profits from many trades. But both ways can be risky.

- How You Study the Market: Swing traders look at the big picture—what’s happening over days or weeks. Day traders only care about what’s happening that day.

- Cost of Trading: Since swing traders make fewer trades, they usually pay less in trading fees. Day traders often pay more because they trade a lot.

Simple Swing Trading Strategies in Crypto

Let’s talk about some popular ways people use a crypto swing trading strategy in the market. These strategies help traders decide when to buy and when to sell.

- Fibonacci Retracement

This is a big word, but it is really simple. Traders use it to create lines on a price chart. These lines enable them to be able to see where the price may bounce back or drop. The lines indicate “support” (a low price that may go higher) and “resistance” (a high price that may drop). Fibonacci retracement is a common tool in a crypto swing trading strategy. - Support and Resistance Levels

These are key prices on a chart.

Support is a low price where traders think the coin will stop falling and maybe go up.

Resistance is a high price where traders think the coin might stop going up and start to fall.

Traders use these spots to decide when to enter or exit a trade. Identifying these levels is essential in any crypto swing trading strategy. - Bollinger Bands

Bollinger Bands are three lines on a chart—an upper line, a lower line, and a middle line.

When the price goes near the top line, it means the coin might be too expensive right now (overbought).

When it goes near the bottom line, it might be too cheap (oversold).

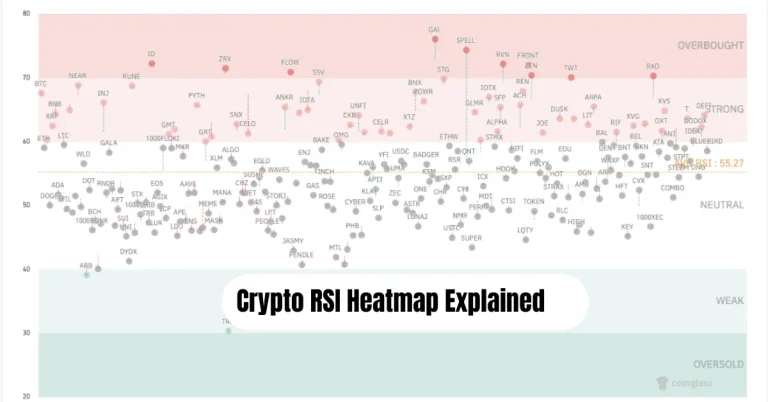

This helps the traders know when to sell or purchase. Bollinger Bands are utilized by others in conjunction with other indicators like RSI (Relative Strength Index) to get other clues about price movement. This combination can strengthen your crypto swing trading strategy. - Trend-Catching Strategy

This strategy is all about spotting trends. A trend means the price is going mostly up or mostly down over time.

If you are watching a strong uptrend, then you can purchase and wait for the price to rise.

If you see a downtrend, you might stay away or even sell if you think the price will keep going lower.

Be careful, however—crypto trends can reverse in the blink of an eye. You have to continue monitoring the charts so that the trend is still occurring in your favor. Trend following is a classic crypto swing trading strategy.

Conclusion

Swing trading is a wise compromise between quick trading and long-term investing. The key to a successful crypto swing trading strategy is to stick with a good plan. You need to watch what the market is doing. If the market is trending upward, then perhaps it’s time to buy on a string of small price declines.

One of the most important swing trading rules is not to let little losses become large ones. If a trade does not go your way, it is best to cut it short. Little losses are unavoidable, but large losses can slow down your progress significantly.

Read also :

FAQs

1. Is swing trading good for beginners?

Yes, a crypto swing trading strategy can be a good choice for beginners because you don’t have to trade every day. You get more time to think and plan your trades carefully.

2. How much money do I need to start swing trading crypto?

You don’t need a lot to start. Even a small amount like $100 can work, especially if you are just learning. Just make sure you only use money you can afford to lose.

3. Can I swing trade using just my phone?

Yes! Most crypto apps let you trade, check charts, and set alerts right from your phone. Just be careful and avoid rushing into trades without thinking. A crypto swing trading strategy can be managed from your mobile device for added convenience.