Crypto Funding Rate Heatmap Explained (How To Use It Right)

One of the most underrated and powerful tools that any crypto trader can add to their toolbox is the Crypto Funding Rate heatmap. It provides a visual reading of market sentiment that shows investors when traders are excessively bullish or bearish. In other words, it indicates how much traders are paying or getting paid to hold long or short positions in the crypto futures market, and that can be very valuable information.

Reading the Crypto Funding Rate heatmap properly allows you to see possible market reversals, trade against the crowd, and be more decisive. This post will explain what exactly a Crypto Funding Rate heatmap is, how it operates, and most importantly, how you can incorporate this in your trading process. Whether you’re looking to control risk, improve entries and exits, or avoid expensive errors, having a handle on this tool can provide you with a genuine advantage in the universe of crypto.

Crypto Funding Rate—What is it?

Crypto Funding Rate is a crucial mechanism in a perpetual futures contract to ensure that the price continues to stay close to the market (spot) price of the cryptocurrency. Whereas traditional futures expire at specific dates, perpetual contracts never expire, so Crypto Funding Rates are introduced as periodic payments between traders to keep their balances in check.

When the market is too bullish, with the majority of traders betting on the upside (going long), the Crypto Funding Rate is positive, so longs pay a short fee. It becomes negative when the market is excessively bearish and short traders are paying the longs. These would be made every 8 hours, and determined by the gap between futures and spot prices. This can help traders see through that and have a clearer edge in timing the market.

Perpetual Swap in Crypto: Explained

Perpetual swaps are a popular kind of derivative in the crypto world that enable traders to bet on the price of digital assets such as Bitcoin or Ethereum, without owning the tokens themselves. What sets them apart is that, unlike ordinary futures contracts, they do not have an expiration date — they can be held indefinitely. These contracts are structured to track the price of the underlying asset closely and employ a mechanism dubbed the Crypto Funding Rate to zero in on the spot market. Trading with high leverage is one of the great attractions of trading in perpetual swaps.

This makes it possible for a trader to control a large position without having to spend a lot of capital. But this also makes the risk a lot higher. It can liquidate the position, and the trader can lose everything. Perpetual swaps can be an opportunity, but they require caution and skill.

For instance, if Alex wants to buy $100,000 of Bitcoin, but only has $1,000 in their trading account. Due to the 100x leverage, Alex can manage the entire trade value. If Bitcoin’s price rises, Alex could make huge profits. But even if 1% price moves, it will result in losing the entire $1,000, and the position would be liquidated.

Perpetual Swaps and How They Work for Funding Rates

Even if Alex makes a lot of money on a leveraged trade, there’s another cost to bear in mind — Crypto Funding Rates. These are small amounts of payment that traders pay to each other, and which flow to the exchanges themselves, typically every eight hours, varying depending on the crypto exchange and the overall market. Here’s the simple logic:

When the market is bullish and everyone’s going long (expecting the price to go up), long traders pay a funding fee to shorts. This is known as a positive Crypto Funding Rate. Conversely, in a bear market, where the majority of traders are short (in other words, betting on the likelihood of prices falling), it will be short traders who will pay funding to the longs—a negative Crypto Funding Rate. Ultimately, it’s Crypto Funding Rates that drive perpetual swap prices close to actual crypto market prices, which is what you see happen in practice.

Crypto Funding Rate Heatmap—Explained

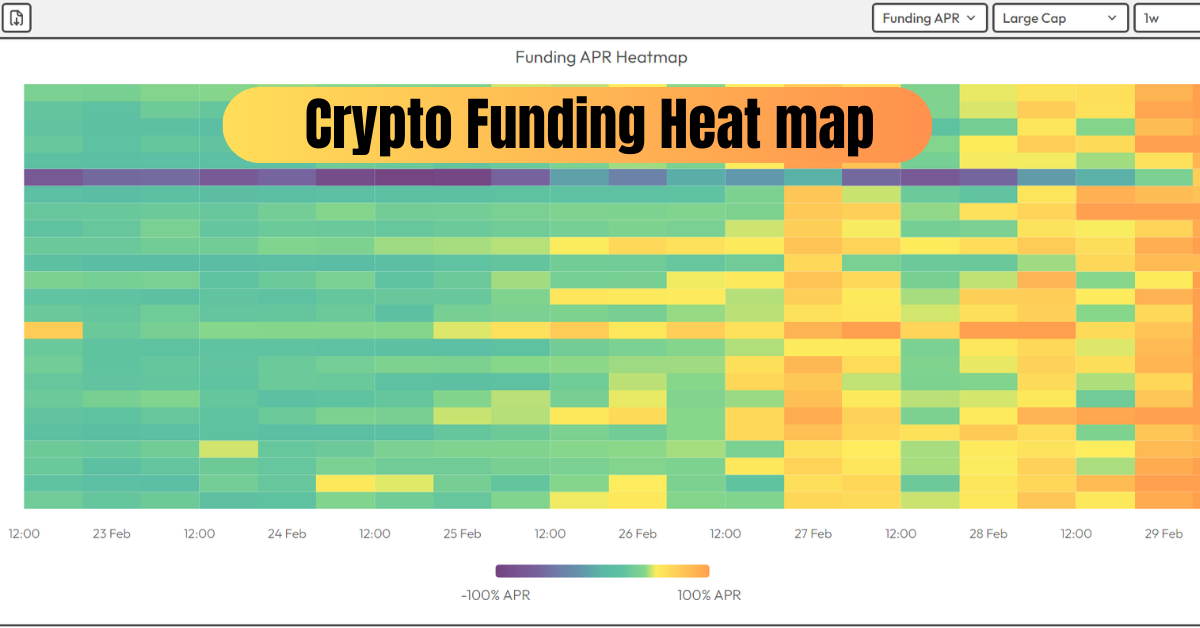

The Crypto Funding Rate heat map is a visual representation showing the funding rates for perpetual futures contracts at different cryptocurrencies and exchanges. Crypto Funding Rates are regular payments that longs and shorts pay to hold their positions, intended to incentivize the perpetual futures price to not stray too far from the underlying asset’s spot price. Where a perpetual contract is trading at a premium to its spot price, long position holders will pay funding to short position holders and vice versa.

A heat map that uses color gradients — green for positive rates (longs paying shorts) and red for negative rates (shorts paying longs) reflects market sentiment and the cost of carrying positions. They use it to estimate the market sentiment or to find situations in which some players may get overwhelmed, depending on whether the indicator drops below or rises above a certain level. Crypto Funding Rate analysis helps you predict likely price corrections or continuations to further improve your strategy and risk management.

How Perpetual Swaps Funding Rate Works?

Even if Alex is taking a leveraged trade and making huge money, there is another cost to consider—the Crypto Funding Rate. These are small payments that traders give to one another, typically every eight hours, depending on the crypto exchange and prevailing market conditions. The simple logic is that when the market is bullish, and a majority of traders are going long (buying, expecting prices to increase), long traders pay a Crypto Funding Rate to short traders.

This is known as a positive Crypto Funding Rate. Conversely, in a bear market, when most traders are negative to the market and are shorting (betting on prices falling), short traders are paid funding by the longs, which becomes a negative Crypto Funding Rate. Such payments serve to keep the market in equilibrium. They persuade large and market-making investors to take the other side of overly crowded trades. In the end, it’s Crypto Funding Rates that help maintain that close reprieve between actual market and perpetual swap prices.

Key Considerations—Crypto Funding Rate Heatmap

- Perpetual swaps are a kind of futures contract created for trading crypto. Unlike traditional futures, they do not expire, so traders can hold their positions indefinitely, and yet still have them track the real-time price of digital assets like Bitcoin or Ethereum.

- If one of the best features of perps is their high leverage, it may also be one of the riskiest. Just because you can trade with 50x or 100x leverage, doesn’t mean you should. One small adverse price move on trade can trigger immediate liquidation. Remember to always trade using proper risk management.

- The Crypto Funding Rate Heatmap is an awesome visual representation that overlays how Crypto Funding Rates have changed over time for a variety of assets. The warm colors, orange or red, are signs of extreme market sentiment—and often a danger signal that the crowd could be wrong. Keep ahead of dangerous trends with this heatmap.

Conclusion

The Crypto Funding Rate heatmap is a clever tool for crypto traders to observe market trends, eliminate emotional trading, and make sensible decisions. If they understand how Crypto Funding Rates work, and you’re making use of the heatmap to gauge market sentiment, it’s easy to avoid common errors (such as buying at the top or selling at the bottom). It’s not that you predict the future, but that you read the signs the market gives you. Combine this with effective risk management, and you’ll be better equipped to manage the volatility of trading crypto.

Read also

FAQs—Crypto Funding Rate Heatmap

1.What’s a Crypto Funding Rate heatmap?

A Crypto Funding Rate heatmap is a graphical representation of the evolution of Crypto Funding Rates across perpetual swaps. It does so by using colors to show you whether rates are high or low, which can help you quickly spot market trends and extremes in trader sentiment.

2.How can I interpret the Crypto Funding Rate heatmap?

Warmer colors (like orange or red) typically suggest that Crypto Funding Rates are high and long positions are overfull. Cooler colors (such as blue or green) indicate the market is bearish or neutral. These are the signals that can help you trade smarter.

3.Can the Crypto Funding Rate heatmap forecast the prices of crypto?

No. The Crypto Funding Rate heatmap isn’t a price predictor, but it reflects market sentiment. If the Crypto Funding Rate is quite high or very low, that could indicate that a trend change is around the corner. It’s a road map for making decisions, not an absolute guarantee.