Bitcoin Stock Strategy Barbell Explained: Muscle Up Your Portfolio

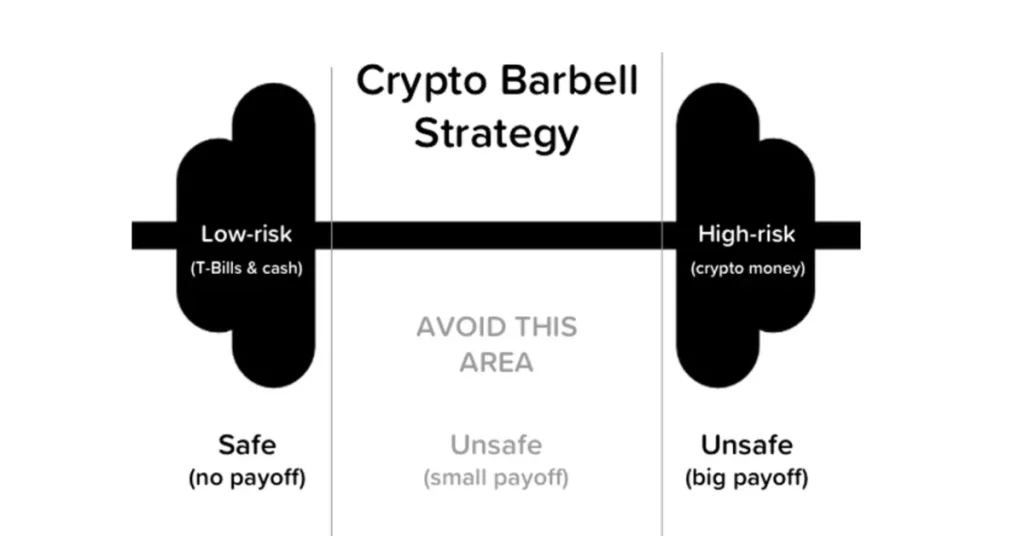

Have you ever looked at a weightlifting barbell and thought, Hey, that looks a lot like my investment strategy? Probably not, right? But believe it or not, there is a really smart way to invest, especially in Bitcoin and crypto, that is inspired by that very image. It is called the Barbell Strategy, and it is all about getting super strong on both ends of your investment portfolio—one end super safe, the other super risky – while avoiding the middle. If you’re searching for a Bitcoin Stock strategy that balances risk and reward, the Barbell approach is worth considering.

The Bitcoin Barbell Strategy: Building a Portfolio

A barbell strategy is a way to invest your money smartly. You put most of your money (like 80%) into something very safe, like a savings account or government bonds. Then, you put a small part (like 20%) into something risky, like stocks or new businesses. This is a classic approach for anyone looking for a Bitcoin Stock strategy that limits downside while still offering upside potential.

This plan helps you stay safe during bad times because most of your money is in safe places. But it also gives you a chance to grow your money during good times, with the risky part. So, it is like playing it safe while still giving yourself a chance to win big.

When you use the barbell strategy, you focus on the two ends—very safe and very risky. You don’t put your money in things that are in the middle, like medium-risk investments. For those seeking a Bitcoin Stock strategy that avoids the mediocre middle, this method is ideal.

For example, safe things could be bonds or even gold. Risky things could be tech stocks or Bitcoin, which can go up and down a lot. More and more regular people are starting to like this strategy. They are thinking about using it to help grow and protect their money at the same time, especially as a Bitcoin Stock strategy in volatile markets.

Why Does This Make Sense for Bitcoin and Crypto?

Now, let’s talk about Bitcoin and the wider crypto market. If you have been around crypto for even five minutes, you know it is a rollercoaster. Prices can skyrocket one day and crash the next. This extreme volatility is exactly why the Barbell Strategy can be useful as a Bitcoin Stock strategy.

Here is how the Barbell Strategy typically works with Bitcoin and other digital assets:

- The Safe Side: This is where you put the majority of your investment. In the crypto world, safe is a relative term, but it generally means established cryptocurrencies with large market values and a proven track record. Think Bitcoin (BTC) and Ethereum (ETH).They are considered more stable and reliable than thousands of newer, smaller altcoins. You might also include stablecoins (like USDT or USDC) if your goal is to have some truly stable capital within your crypto holdings. The goal here is not massive growth, but capital preservation. This is a foundational aspect of any Bitcoin Stock strategy focused on security.

- The Risky Side: This is where you allocate a smaller percentage of your portfolio, but it is where you chase those potentially life-changing gains. This side includes:

- Small-cap altcoins: These are newer, smaller cryptocurrencies with less history but huge growth potential if their projects take off.

- DeFi projects: Decentralized Finance is a whole world of new financial services built on blockchains. Investing in these can be super risky but also super rewarding.

- NFTs: Non-fungible tokens, unique digital assets, can be incredibly speculative.

- Early-stage tokens or ICOs (Initial Coin Offerings): These are like venture capital investments in the crypto world – very high risk, very high reward.

For those who want a Bitcoin Stock strategy that includes high-risk, high-reward opportunities, this is the space to explore.

Why avoid the middle?

The Barbell Strategy argues that medium-risk investments often don’t offer enough upside to justify their risk. They are not safe enough to protect your capital, and they are not risky enough to give you explosive growth. In a world like crypto, where things are so extreme, Taleb suggests it is better to embrace the extremes. This is a key principle for anyone designing a Bitcoin Stock strategy for the digital asset space.

How to Grow Your Portfolio with the Bitcoin Barbell

So, how do you actually put this into practice as part of your Bitcoin Stock strategy?

Figure Out Your Risk Tolerance: This is the absolute first step for any investment strategy. How much risk are you truly comfortable with? Can you sleep at night if your risky investments go to zero? Be honest with yourself. This will determine the “weight” distribution of your barbell.

A common split might be 80% safe and 20% risky, but it could be 90/10 or even 70/30, depending on your personal comfort level and financial goals. For a conservative investor, more goes to the safe side. For someone more aggressive, they might lean a bit more into the risky end. This flexibility is what makes the Bitcoin Stock strategy adaptable to your needs.

- Pick Your Safe Assets: For most crypto investors, this means Bitcoin and Ethereum. They have the largest market caps, the most liquidity, and the strongest networks. You might consider putting a significant chunk of your crypto portfolio into these two. If you’re super risk-averse within crypto, stablecoins are an option, but remember they don’t offer growth.

- Choose Your Risky Bets: This is the fun part, but also the part that requires the most research and discipline. Don’t just blindly pick something because you saw it trending on social media. Look for projects with:

- Strong fundamentals: Does the project solve a real problem?

- A solid team: Who are the people behind it? Do they have experience?… A clear roadmap: What are their plans for the future?

- Active community: Is there a passionate group of users and developers?

Remember, these are highly speculative. You should be prepared to lose the entire amount you invest in these. This is the reality of a Bitcoin Stock strategy that aims for high returns.

- Allocate and Stick to It (Mostly): Once you have decided on your percentages (e.g., 80% BTC/ETH, 20% altcoins), allocate your funds accordingly. The key here is discipline. Do not constantly fiddle with your allocations based on daily price movements.

- Rebalance Periodically: Over time, your percentages will shift. If your risky altcoins explode in value, they might suddenly make up more than 20% of your portfolio.

Or, if they crash, they might be less than 20%. Regularly (e.g., every quarter or half-year) rebalance your portfolio to get back to your original target percentages.

This means selling some of your winners from the risky side and moving them to the safe side or buying more of your safe assets if the risky side has dropped too much. This helps you lock in gains and manage risk. Rebalancing is a crucial part of any disciplined Bitcoin Stock strategy.

Benefits of the Bitcoin Barbell Strategy

Limits Downside Risk: By having a large portion in more established, less volatile assets, you protect the bulk of your capital from the extreme crashes that can happen with smaller, more speculative cryptocurrencies. It is your safety net and a core reason why many choose this Bitcoin Stock strategy.

Maintains High Upside Potential: The small, risky portion is your lottery ticket. If just one or two of those speculative bets hit big, they can significantly boost your overall portfolio returns, even if others fail.

Adaptable to Market Conditions: While you stick to your core allocation, the rebalancing allows you to adapt. In a booming market, you might take profits from your risky assets. In a downturn, you might be able to buy more risky assets at a discount.

Reduces Decision Fatigue: By avoiding the middle, you simplify your choices. You are not trying to constantly find moderately risky assets. You focus on the extremes.

Emotional Resilience: Knowing that the majority of your funds are relatively safe can help you stomach the wild swings of the risky side without panicking and making bad decisions. This emotional buffer is a hidden benefit of the Bitcoin Stock strategy.

Risks to Consider

No investment strategy is foolproof, and the Bitcoin Barbell Strategy has its own set of risks:

- Safe is Relative in Crypto: Even Bitcoin and Ethereum can experience massive price drops. What’s considered safe in crypto is still very volatile compared to traditional investments. You still need to be comfortable with significant fluctuations in your safe assets.

- Loss on Risky Side: You absolutely will lose money on some of your risky bets. That’s part of the strategy. The goal is for the few big winners to more than make up for the many losers.

- Missed Middle Opportunities: While the strategy avoids the middle, there might be some excellent mid-cap projects that offer good risk-adjusted returns that you are skipping over.

- Requires Discipline: Rebalancing and sticking to your allocation, especially when things are going crazy, requires strong discipline. It is easy to get greedy or fearful and deviate from the plan.

- Research Intensive (for the risky side): You need to do your homework on those smaller, riskier projects. Blindly throwing money at them is a recipe for disaster. This is especially true for the risky component of your Bitcoin Stock strategy.

Ready to Lift Your Portfolio?

The Bitcoin Barbell Strategy provides a compelling model for investing in the thrilling but volatile realm of cryptocurrency. By intentionally concentrating your investments at the limits of safety and speculation, you create a portfolio that is positioned to weather unforeseen shocks but still provides the potential for a tremendous upside. It is not a matter of eliminating risk altogether, but of handling it smartly. So, if you are willing to beef up your crypto portfolio, the barbell could be the Bitcoin Stock strategy for you!

Read also :

FAQs

1.Is the Barbell Strategy only for bonds, or can it really apply to crypto?

While the Barbell Strategy was first talked about with bonds (short-term and long-term, avoiding medium), its core idea of balancing extremes of risk and reward is super applicable to any asset class, especially one as volatile as crypto. As a Bitcoin Stock strategy, it is particularly effective.

2.How much should I put into the safe vs. risky side?

This is entirely personal and depends on your comfort with risk. A common starting point for many is an 80/20 split (80% safe, 20% risky). If you are very conservative, you might go 90/10. If you are more aggressive and have a higher risk tolerance, you might consider 70/30. These ratios are a key part of customizing your Bitcoin Stock strategy.

3.What if my risky crypto investments go to zero? Does the strategy still work?

Yes, that’s exactly what the strategy accounts for! The whole idea is that you are investing a small, manageable portion in those high-risk, high-reward assets. If some of them go to zero, your larger safe allocation in Bitcoin and Ethereum acts as a buffer, protecting the majority of your portfolio. This safety net is a hallmark of a well-designed Bitcoin Stock strategy.