Bitcoin Rally Met With Institutional Call Selling In Options Market – Details

Bitcoin’s recent surge to an all-time high has been followed by a sharp correction amid renewed concerns about global economic tensions. Institutional investors appear to have approached the rally with caution, strategically positioning in the options market to hedge risks and lock in profits.

Institutional Investors Take Defensive Stance During Bitcoin Surge

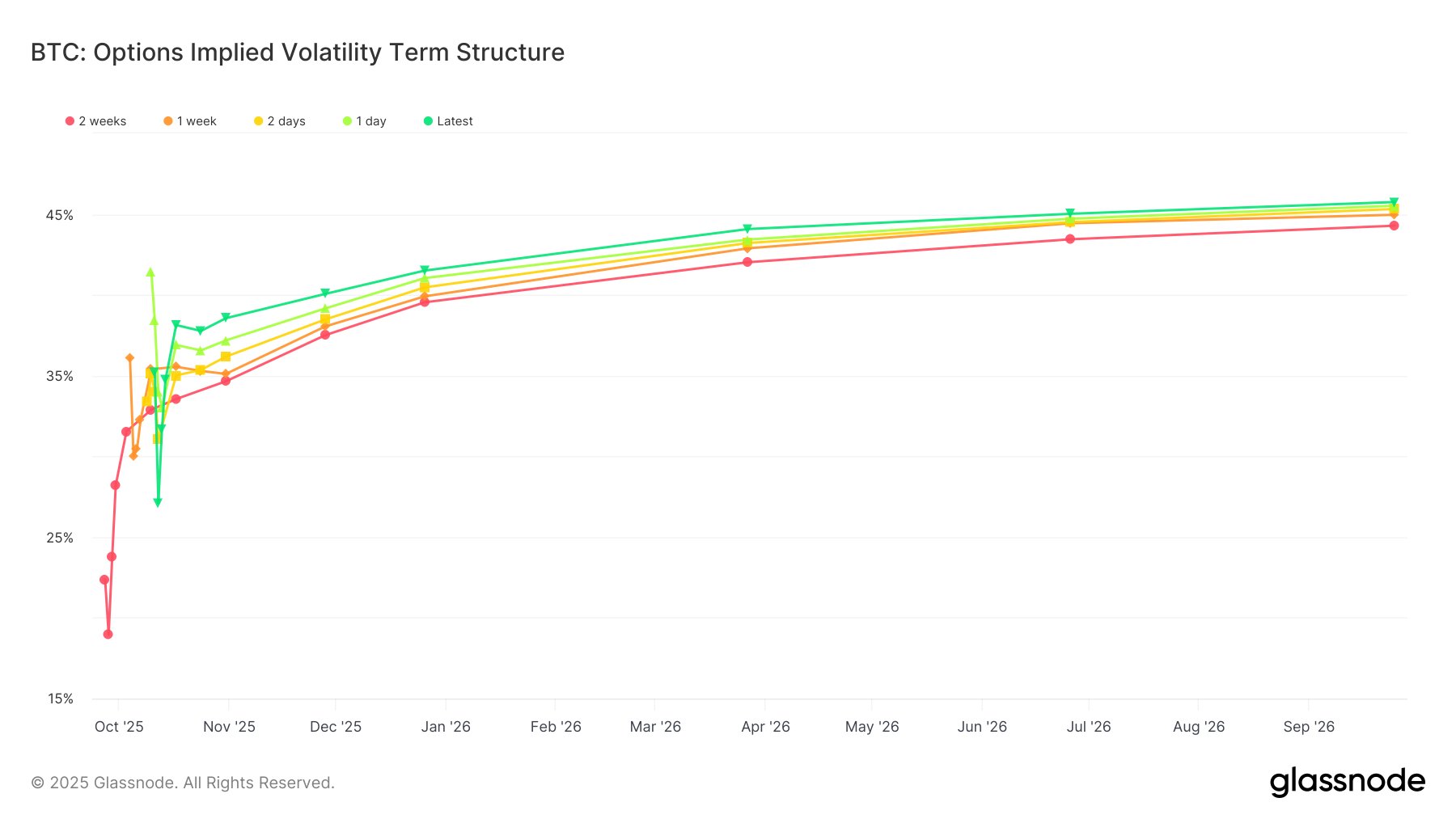

Blockchain analytics firm Glassnode revealed in its October 10 market update that institutional traders largely avoided chasing Bitcoin’s latest rally, which saw the asset reach a record $126,198.17 on October 6, 2025. Instead, they employed a defensive strategy, selling call options and maintaining exposure to put contracts as the market moved higher.

Despite Bitcoin gaining over 10% during the ascent, implied volatility remained muted at around 38–40%. This subdued reaction suggests institutions were either already positioned for the move or showed restraint amid the euphoria, unwilling to pursue additional upside at elevated levels.

Analysts also noted key developments in options skew during the rally. Demand for put options persisted, and the put-call ratio rose above 1.0 ahead of the Friday, October 9 expiration—an indication of increased hedging activity as investors anticipated potential downside.

“This cycle is showcasing a more mature and disciplined Bitcoin market, where institutional players dominate the flows,” Glassnode stated. The report attributes this shift to growing institutional adoption through Bitcoin spot ETFs and the emergence of crypto-focused treasury strategies, contributing to the broader stability of the market.

Market Impact amid Geopolitical Tensions

Bitcoin’s rally came to an abrupt end following renewed fears of a potential trade war between the US and China, leading to a steep correction. The price dropped significantly within hours to around $110,000, erasing gains made earlier in the month. Analysts link this turn to increased investor anxiety over macroeconomic instability.

BTC Price Update

As of writing, Bitcoin is trading at $110,805, recording a 7.54% loss in the last 24 hours. Trading volume has spiked by 150.37% during the same period, signaling heightened market activity as traders reevaluate positions in light of the current correction.