Bitcoin Production Cost Indicator Explained (How To Use It)

One thing that is very valuable to investors is the price of mining one Bitcoin, also known as the Bitcoin Production Cost. This metric, sometimes referred to as the Bitcoin Mining Cost or cost to mine Bitcoin, can be beneficial to use as a means of understanding whether the market is doing well or not35. If you know how costly it is to mine Bitcoin, you will be able to approximate whether the price is high or low and maybe buy or sell accordingly.

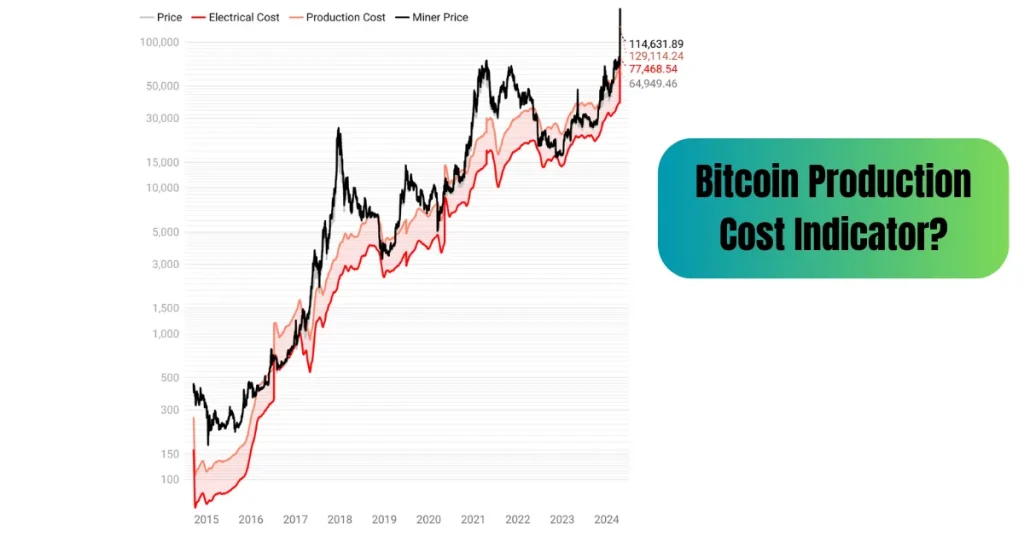

One cool tool that helps with this is the Bitcoin Production Cost Indicator from Capriole Investments. It shows whether Bitcoin is “cheap” or “expensive” based on how much it costs to make it. In this guide, we will explain what the Bitcoin Production Cost Indicator means and how this indicator works.

What Is Bitcoin Production Cost?

The Bitcoin Production Cost (also called Bitcoin Mining Cost) is how much money it takes to create one Bitcoin. This includes things like:

- Electricity

- Mining machines

- Labor

- Other equipment and maintenance

This cost changes depending on where you are in the world, how much electricity costs, and what kind of mining machines you are using.

Miners are people (or companies) who run big computers to solve math problems. When they solve these problems, they get new Bitcoins as a reward. But all that computer work takes a lot of power, so it can be expensive. If the price of Bitcoin is lower than the Bitcoin Production Cost, miners lose money.

What Is the Bitcoin Production Cost Indicator?

Capriole Investments made a chart called the Bitcoin Production Cost Indicator. This chart helps estimate how much it costs, on average, to produce one Bitcoin on any given day.

Here is how it works:

- The purple line shows the total Bitcoin Mining Production Cost (including electricity and hardware).

- The red line shows just the electricity cost.

- The green line represents the average price that miners are selling their Bitcoin at—they sell to cover their bills and stay in business.

If the green line is lower than the purple line, that means miners are selling Bitcoin at prices lower than their Bitcoin Production Cost. That’s not good for them, and this area on the chart is shaded dark red.

If the green line is above the red line but still under the purple one, miners are at least covering their daily electricity bills, but they are not making a profit. This area is light red on the chart.

Why Did the Costs Go Up?

You might notice that recently, both the red and purple lines have gone way up on the chart. That is because of something called the Bitcoin halving, which happened in April 2024.

Every few years, the reward that miners get for making a block of Bitcoin gets cut in half. That means they now earn half as many Bitcoins for doing the same amount of work. But the problem is—they still need to run their machines and use a lot of electricity. So now, they must use double the amount of electricity just to gain the same volume of Bitcoin. That is the reason why the Bitcoin Mining Cost (red line) increased from around $30,000 to $60,000 per Bitcoin.

Now, if you glance at the chart of the price of Bitcoin, you will notice it is only slightly above the $60,000 mark. So that means that Bitcoin remains slightly higher than the cost to mine Bitcoin, but only just.

Why Should You Care?

If you are considering an investment in Bitcoin, being aware of the Bitcoin Production Cost is a useful tool. If the price of Bitcoin falls below the cost of producing Bitcoin, mining may cease, and fewer Bitcoins will be created. That can have an impact on the market in significant ways.

The Bitcoin Production Cost Indicator makes it easier for you to observe when Bitcoin may be undervalued (affordable) or overvalued (pricey). It won’t inform you directly what to do, yet it provides you with another method of comprehending what’s truly occurring in the background.

Why Is the Bitcoin Production Cost Indicator Important for Investors?

The Bitcoin Production Cost Indicator is a really helpful tool for investors. It does not just show how much it costs to make Bitcoin—it also gives clues about the market and helps people plan their next move. Let us look at why it matters:

- Helps You See If Mining Is Worth It

If you are thinking of mining Bitcoins, you have to ask yourself if you will be making money or losing it. If you put the value of how much you spend to mine one Bitcoin against how much you will sell it for, then you can decide if you can make it a business venture. If your Bitcoin Mining Expense is higher than the value of Bitcoin, then mining is not the time to do it. - Gives Clues About the Market

The cost to mine Bitcoin can also tell us a lot about what is going on in the world of crypto. For example, if the Bitcoin Mining Cost is increasing but the cost of Bitcoin is low, it could be an indication that the market is bad (a so-called bear market). But if prices are high and costs are low, things might be looking up. - Helps Plan Investment Strategies

Smart investors do not just guess—they look at facts. The Bitcoin Production Cost Indicator can help investors think about risk and reward. If the price of Bitcoin is way above the cost of producing Bitcoin, it could be a sign that it is a good time to invest. If not, it might be time to wait or be more careful.

Is Bitcoin a Good Deal Right Now?

Let’s be honest—no one can predict the future of Bitcoin. But if we look at something called the Bitcoin Production Cost Indicator, we can get a pretty good idea of when Bitcoin might be a great deal.

This tool shows how much it costs, on average, to make (or mine) one Bitcoin. The red line on the chart shows the daily Bitcoin Mining Cost. And guess what? Bitcoin’s price almost never drops below that red line. And if it does, it usually bounces back up pretty quickly.

Why Does That Matter?

Here is what’s really interesting: in the past, buying Bitcoin when its price was at or just under that red line turned out to be a smart long-term move.

Let’s look at some big moments:

- During the 2018 and 2022 bear markets, the price dropped close to the red line. That was a great time to buy.

- The same thing happened in the 2020 COVID crash—Bitcoin was trading near its production cost, and then it went way up afterward.

- After each Bitcoin halving, the price usually drops for a bit, then goes up again. That’s what seems to be happening right now.

So, is Bitcoin going to drop again soon? Maybe. Nobody knows for sure. But if you go by the history of the Bitcoin Production Cost Indicator, this could be a good time to buy for the long run.

Final Thoughts

The cost to mine Bitcoin is more than just a number—it is a clue. If you understand it, you can use it to make smarter choices about when to buy or sell. But remember, everyone’s financial situation is different. Always think about your own goals, how much risk you’re okay with, and never invest money you can’t afford to lose.

Read More:

FAQs– Bitcoin Production Cost

1. What is the Bitcoin Production Cost Indicator?

It is a chart that shows how much it costs, on average, to mine one Bitcoin. It includes things like electricity and equipment costs.

2. Why is the red line on the chart important?

The red line shows the daily Bitcoin Mining Cost. When Bitcoin’s price goes below this line, it usually doesn’t stay there for long. That’s why some people think it’s a smart time to buy.

3. Is now a good time to buy Bitcoin?

Based on past data, buying Bitcoin near or below its production cost has been a good long-term move. But no one can guarantee what will happen next.

4. What happens after a Bitcoin halving?

Usually, the price drops a little at first, then climbs to new highs over the next few months.

5. Should I invest in Bitcoin just because of this chart?

Not by itself. This chart is helpful, but it’s just one piece of the puzzle. Always consider your money situation and do more research before investing.

3 Comments