Bitcoin Price Wedged Between 2 Crucial levels — What To Expect In Coming Days

Bitcoin’s price has stalled following a bearish shift earlier this month, placing the cryptocurrency between two critical technical support levels. Analysts warn that a breach of the lower boundary could lead to a deeper correction, while a move above resistance may reignite bullish momentum. Recent trading volumes have reflected this uncertainty, and traders are now seeking clarity on market direction. Historical price movements suggest that periods of consolidation often precede significant price shifts, making this a crucial moment for Bitcoin traders. Observing volume trends alongside price movements can provide insights into whether buyers or sellers hold the upper hand in this market. Currently, many are asking why the Bitcoin price is stuck and what that means for future trading strategies. Many in the community are concerned with the overall market as the Bitcoin Price Stuck at critical levels.

Background: Bitcoin Struggles in ‘Uptober’ Despite Strong Start

This situation has left many wondering about the Bitcoin Price Stuck in this range and what signals to look for moving forward.

As the discussion around the Bitcoin Price Stuck continues, traders are analyzing potential breakout points that could signal the next significant move.

Historically celebrated as a bullish period, Bitcoin’s performance in “Uptober” has been underwhelming in 2024. After a promising start, the market downturn on October 10 dragged prices lower, erasing gains and adding uncertainty for traders and investors. The flagship cryptocurrency dropped to a new monthly low of around $103,000 on Friday, October 18, raising concerns about the sustainability of the current market cycle. Analysts are examining past ‘Uptober’ trends to assess whether this downturn is an anomaly or part of a larger bearish trend. By analyzing previous years, traders can better understand potential price actions as October progresses, which historically has included significant price reversals.

The ongoing debate about why the Bitcoin Price Stuck in this downturn has led to various opinions among analysts, highlighting the importance of technical indicators.

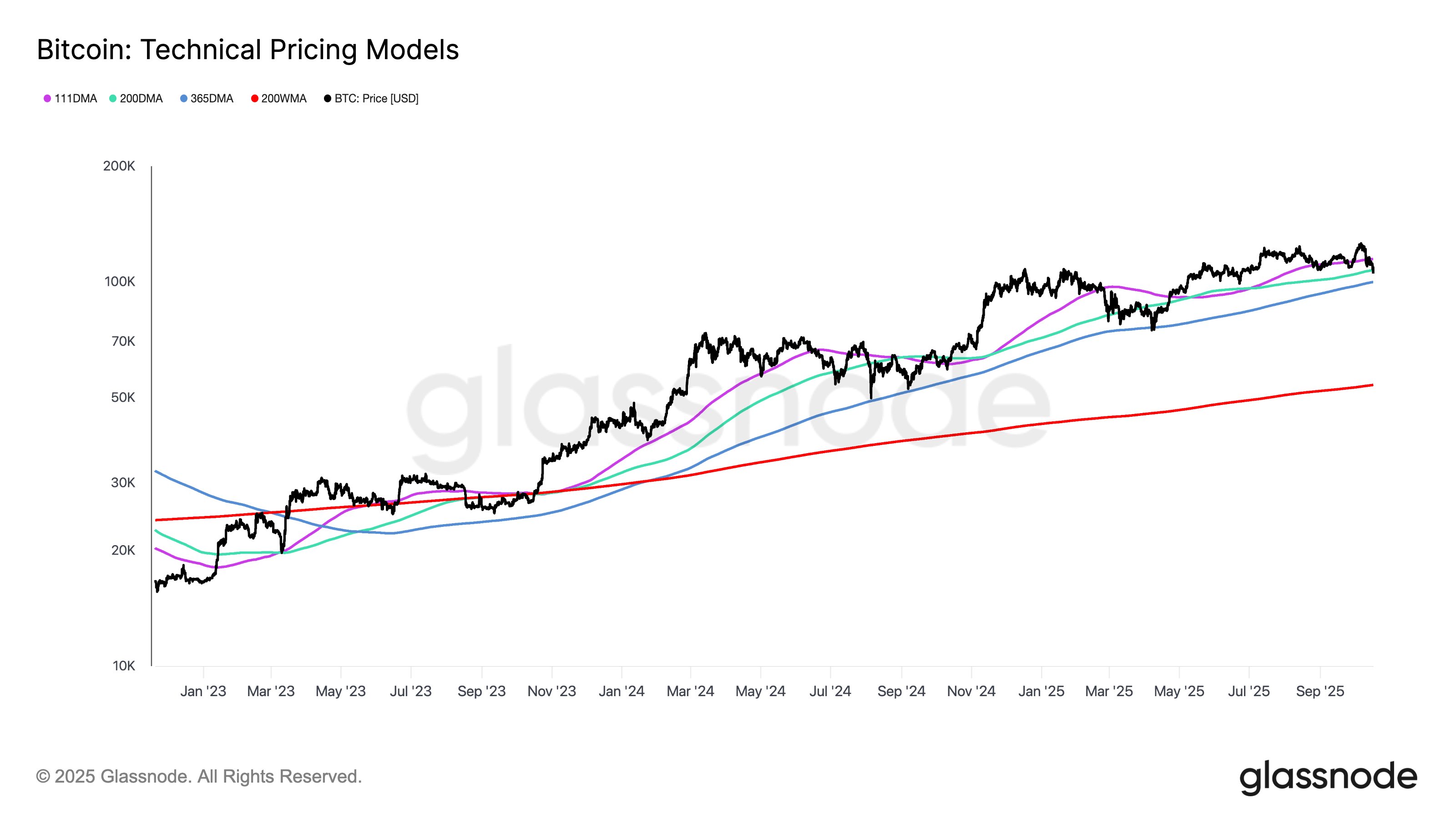

Technical Setup: BTC Trapped Between Mayer Multiple and Yearly Moving Average

Blockchain analytics firm Glassnode highlighted Bitcoin’s precarious technical position in an October 17 post on X (formerly Twitter). According to their analysis, the asset is presently trading in a narrow range between two significant support zones: the 200-day Simple Moving Average (the Mayer Multiple) at $107,400 and the 365-day Moving Average at $99,900. Such technical indicators are crucial for traders as they navigate potential entry and exit points. Understanding the implications of these averages can help investors make informed decisions amidst market volatility.

The Mayer Multiple is often viewed as a key marker separating bullish from bearish market phases. Falling below this level suggests weakening bullish momentum. Currently, Bitcoin is under the Mayer Multiple line, and though it still holds above the 365-day MA, slipping further could signify a longer-term bearish reversal. Traders should note the historical performance of Bitcoin when it has fallen below the Mayer Multiple, as this has often been a precursor to more significant price declines, prompting investors to reassess their holdings.

For many traders, understanding why the Bitcoin Price Stuck below the Mayer Multiple is critical to formulating their next steps in the market.

Maintaining the $99,900 support is now crucial. Breaking below it could trigger heightened selling pressure and a deeper correction. Conversely, reclaiming the Mayer Multiple might restore confidence among bulls, though analysts also point to additional resistance around the 111-day moving average at approximately $114,700. This resistance level has historically been a pivot point, where many traders have entered or exited positions. Observing how Bitcoin behaves relative to this moving average can provide essential insights into market sentiment and potential price movements.

The significance of the $99,900 support level is emphasized further by the ongoing Bitcoin Price Stuck scenario that analysts are monitoring closely.

Market Impact and Investor Sentiment

Short-term price action has raised caution among market participants. With Bitcoin hovering close to crucial support, traders are closely watching technical indicators to determine the next move. While some view the consolidation as a brief pause, others warn that failure to break resistance could foster bearish sentiment heading into the final weeks of October. Investor sentiment appears mixed; as some analysts remain optimistic about a potential reversal, others emphasize the need for sustained upward momentum to attract new buyers into the market.

Bitcoin Price Update

At the time of reporting, Bitcoin is trading near $106,427, marking a nearly 2% decline over the past 24 hours. The market remains volatile, with price direction expected to be influenced by upcoming macroeconomic developments and investor response to technical levels. Events such as Federal Reserve meetings or significant economic data releases can sway market sentiment dramatically, influencing Bitcoin price action. Traders should remain vigilant and adapt their strategies based on both technical analysis and macroeconomic factors impacting the cryptocurrency landscape.

Conclusion: Bitcoin Price Stuck

In conclusion, the market remains uncertain as the Bitcoin Price Stuck at these levels prompts traders to reassess their strategies.

Future Outlook for Bitcoin Traders

Looking ahead, understanding the reasons behind the Bitcoin Price Stuck will be crucial for traders aiming to capitalize on future movements.