Bitcoin Miners Hold On To Their Coins Despite Low Profitability — Details

Bitcoin Miners Retain Holdings Despite Record-Low Profitability

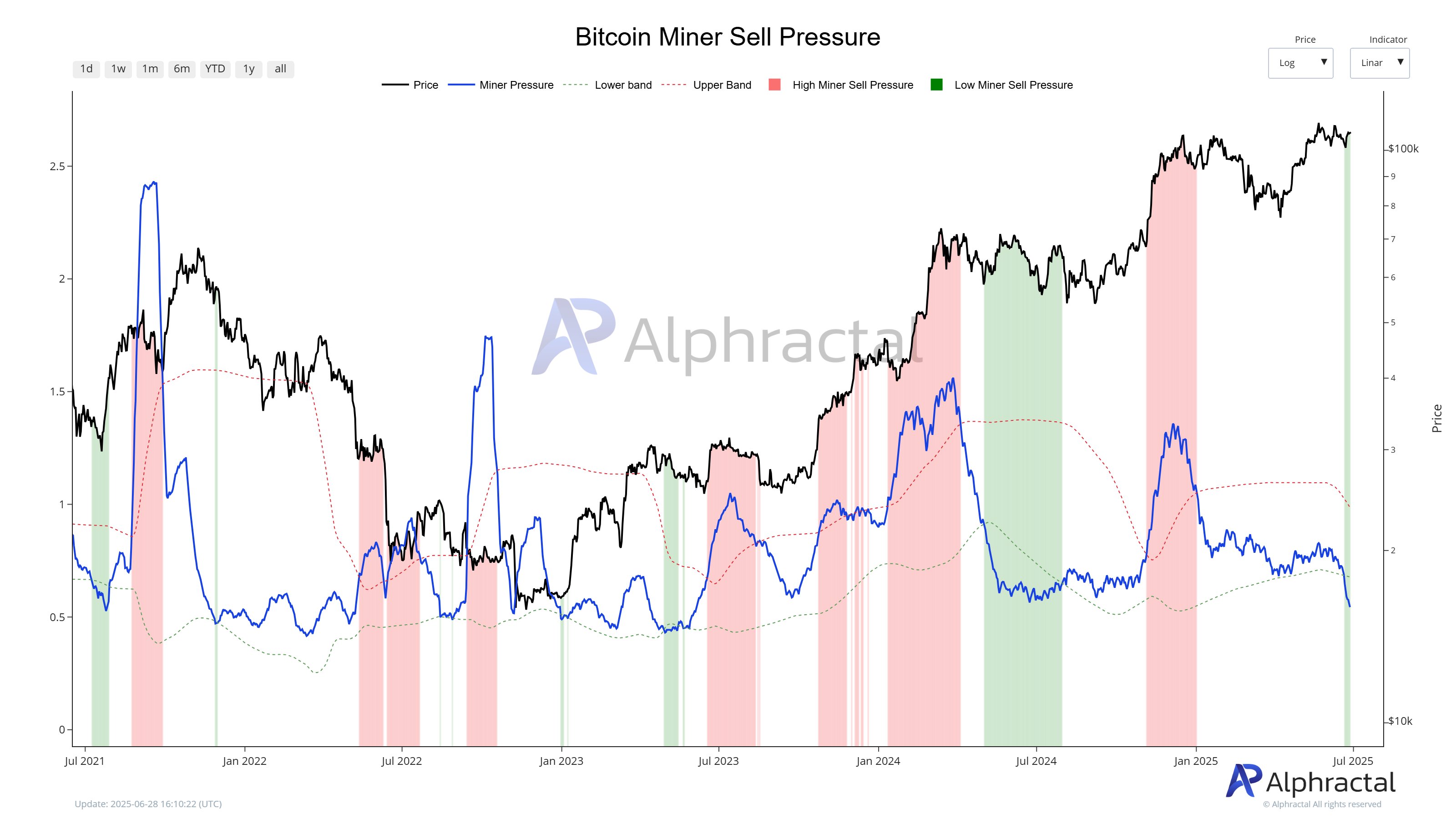

Summary: On-chain data reveals that Bitcoin miners are holding on to their BTC reserves despite historically low profits, driven by a sharp decline in transaction fees and rising mining difficulty.

BTC Transaction Fees Hit Lowest Level Since 2012

According to blockchain analytics firm Alphractal, Bitcoin miners are refraining from selling their holdings despite a substantial drop in revenue. In a recent post on X (formerly Twitter), the firm highlighted that total transaction fees on the Bitcoin network have fallen to levels not seen since 2012, primarily due to reduced on-chain activity during the current cycle.

The low network activity has significantly impacted miners, who typically rely on transaction fees in addition to block rewards for income. Compounding the issue, mining difficulty remains high even though the network’s hash rate recently declined, further squeezing profit margins.

Alphractal noted increased volatility in Bitcoin’s hash rate, which has reached all-time highs, suggesting that large mining operations may be powering down ASIC machines. This, the firm said, is likely a response to an unfavorable economic environment marked by low profitability and subdued network demand.

“This is likely caused by large mining operations shutting down ASIC machines, possibly due to falling revenues and low network demand,” Alphractal commented.

Miners Maintain Low Selling Pressure

Despite mounting financial pressure, miner sell-offs have remained minimal. Alphractal’s data shows low Miner Sell Pressure, indicating that miners are reluctant to liquidate their BTC holdings. The firm considers this a bullish indicator for Bitcoin’s market stability.

Alphractal added that while some mining pools may be scaling down operations to adapt to current conditions, this is more indicative of a temporary adjustment than a broader miner capitulation. “As BTC trades above $107K, we may simply be witnessing miners reallocating their hash power to adapt to the current demand,” the firm concluded.

Historically, Bitcoin miners tend to sell during price surges and high network activity. The current lack of such conditions suggests a transitional period within the mining sector, rather than widespread financial distress.

Bitcoin Price Update

At the time of writing, Bitcoin is trading at approximately $107,375, reflecting marginal movement with a 0.3% gain over the past 24 hours. The price has remained largely flat, echoing the reduced activity across the network.