Bitcoin Dominance Chart – Track BTC’s Market Strength Live

Have you ever considered how big Bitcoin really is compared to other cryptocurrencies? That’s exactly what the Bitcoin Dominance Chart helps you understand—it shows how much of the crypto market Bitcoin controls compared to the rest.

If you are a newcomer to cryptocurrency, or you just need to find out what’s going on in the market. The Bitcoin dominance chart will be able to tell you with subtle clues whether or not investors are risk-averse towards Bitcoin or experimenting with others like Ethereum or Solana.

In this blog, you will learn what the Bitcoin dominance chart is, how it has changed over time, why it increases or decreases, and why it matters to those who are investing in cryptocurrency.

What Is the Bitcoin Dominance Chart?

The Bitcoin Dominance Chart is a key metric that shows what proportion of the total cryptocurrency market is held by Bitcoin. of the overall cryptocurrency market Bitcoin controls. It indicates what proportion of all the money available out there that exists in crypto form is invested in Bitcoin as opposed to other cryptos such as Ethereum or Solana.

If dominance is high, that means more individuals are investing in Bitcoin compared to other coins. If dominance is low, that means more funds are entering altcoins (the term used for all other cryptocurrencies except Bitcoin).

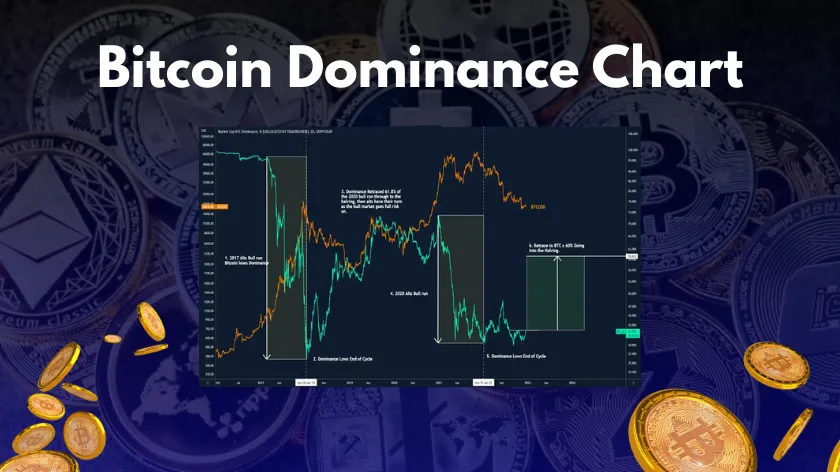

History and Evolution of the Bitcoin Dominance Chart

Let’s take ourselves back to 2009. That was when Bitcoin first existed. It was the sole cryptocurrency then, so it had 100% market dominance—that is, it was the sole competitor in the market.

But that wasn’t the case. More and more cryptocurrencies have arrived over the years, such as Ethereum, Binance Coin, and Solana. Each new coin brought new cool things, such as smart contracts and decentralized finance (also referred to as DeFi) apps. They began to get attention as well, so Bitcoin’s dominance (its percentage of the overall crypto market) gradually decreased.

Although its dominance fell, Bitcoin remains the largest and most widely used cryptocurrency available. Most individuals glance at Bitcoin to observe how the entire crypto market is performing.

What Does the Bitcoin Dominance Chart Tell Us?

The Bitcoin Dominance Chart helps investors understand where confidence is shifting in the crypto space—towards Bitcoin or toward alternative cryptocurrencies (altcoins). Alright, so what is the Bitcoin dominance chart useful for? It actually informs us about how individuals perceive the market.

When the market seems risky or scary, humans tend to go to Bitcoin. It’s regarded as safe and stable, such as a place to hide when it rains. This increases Bitcoin’s dominance.

When things seem positive and exciting, humans tend to buy other coins (altcoins) since they believe they can earn more money. That is when Bitcoin dominance decreases.

So if you notice the Bitcoin Dominance Chart trending upward, it may signal that the market is slightly afraid or confused., it may be that the market is slightly afraid or confused. But if it is declining, it may be that investors are becoming bolder and are willing to try out more cryptos.

Why Does Bitcoin Dominance Change?

Bitcoin dominance doesn’t stay the same. It goes up or down depending on what’s happening in the market.

When the market feels unsafe or uncertain, people usually trust Bitcoin more and move their money there. That causes Bitcoin dominance to go up.

But when the market feels good and exciting, people want to try newer coins that might grow faster. That’s when altcoins get more attention, and Bitcoin dominance goes down.

What Happens When Bitcoin Dominance Changes?

Here is a quick way to understand it:

High Bitcoin Dominance = Bearish (Weak) Market

If Bitcoin is taking up a bigger piece of the market, it usually means that people are scared and want to avoid risk. So they sell altcoins and buy Bitcoin.

Falling Bitcoin Dominance = Bullish (Strong) Market

When Bitcoin’s share goes down, it means investors are feeling hopeful. They want to try other coins because they believe they can make higher profits. This can lead to a market rally, where prices go up.

By watching Bitcoin dominance, traders and investors can get clues about what might happen next in the market.

What Affects Bitcoin Dominance?

The Bitcoin Dominance Chart isn’t static. It fluctuates based on events, investor sentiment, and global trends in the crypto world.There are a few big reasons that can change the percentage of market share that Bitcoin has compared to all the other coins.

Let’s keep it simple.

1. Special Bitcoin Events (Short-Term and Long-Term)

There are periods when events take place that lead to many wanting to sell or purchase Bitcoin suddenly. These can be short- or long-term.

Short-term fluctuations come and go quickly and do not linger for long. For example, if a giant company speaks something positive about Bitcoin, or if Bitcoin is added to a significant exchange, people will suddenly start buying it. Even news about a new form of investment in Bitcoin, like an ETF, can make Bitcoin dominance rise in a matter of a very short time.

Long-term changes are time-consuming but can be more effective. Those are things like Bitcoin halving, which happens from time to time and reduces the number of new Bitcoins minted. When that happens, Bitcoin tends to go up.

Also, if big banks or companies start using Bitcoin more, or if it gets faster and cheaper to use thanks to new technology, more people may invest in it for the long run. This can keep Bitcoin’s dominance high over time.

2. How Investors Are Feeling

People’s feelings about the market, called investor sentiment, also play a big role. When the market feels risky or scary, many people don’t want to take big chances. They usually move their money into Bitcoin because they think it’s safer than other coins. That makes Bitcoin’s dominance go up.

But when the market feels strong and exciting, investors want to try smaller or newer coins (called altcoins) that could give bigger profits. When they move their money into these altcoins, Bitcoin’s share of the market goes down. That’s when Bitcoin dominance falls.

So, whether people are feeling cautious or confident can really change how much Bitcoin is being used compared to other cryptocurrencies.

3. Government Rules and News

What governments do or say about crypto also has a big effect on Bitcoin dominance.

If a country says Bitcoin is legal to use, or if it allows big investment companies to offer Bitcoin products, people feel more comfortable buying Bitcoin. That usually tends to push Bitcoin’s dominance higher.

But if a government enforces tough regulations, such as banning Bitcoin trading or mining or levying high taxes on it, then investors will become frightened. They will refrain from using Bitcoin and try alternative modes such as stablecoins or other altcoins. That can lead to Bitcoin dominance decreasing.

What Happens During Altcoin Season?

During what’s called “altcoin season,” the Bitcoin Dominance Chart often reflects a noticeable dip, signaling that investors are shifting focus from Bitcoin to various altcoins. Altcoin season is a time when altcoins grow faster than Bitcoin. You can see this on the Bitcoin dominance chart — it usually shows a drop during these times.

Why does this happen?

- People feel bold: When investors believe the market is strong, they start buying altcoins because they want bigger profits.

- New ideas show up: New projects and cool tech in the crypto world attract attention, especially if they promise to fix problems or do things Bitcoin can’t.

- FOMO kicks in: FOMO means “fear of missing out.” If a few altcoins start doing really well, others rush in to buy too, hoping to get in early. This makes altcoin season even stronger.

By looking at the Bitcoin dominance chart, you can tell if the altcoin season is starting, getting stronger, or slowing down.

What the Bitcoin Dominance Chart Can’t Show You

While the chart is helpful, it’s not perfect. Here are a few things it doesn’t show well:

1. Stablecoins Make It Confusing

There are coins like USDT and USDC that don’t go up or down much because they are tied to real money like the dollar. Even though they have a lot of value, they aren’t used like regular cryptocurrencies. This can throw off the dominance numbers and make Bitcoin seem smaller than it really is.

2. Too Many New Tokens

New coins and meme coins come out all the time. Even if they’re not very useful or popular, they still take up a share of the market. This can make Bitcoin’s dominance go down, even if Bitcoin is still strong. So, the chart might not always tell the full story.

3. It Ignores Real Use

Bitcoin dominance is all about market size, not real-world use. Some small coins might be super useful but not worth as much yet. So, Bitcoin might seem more dominant just because it’s big, not because it’s being used more than others.

Conclusion

If you’re into crypto investing, keeping an eye on the Bitcoin Dominance Chart can provide valuable insight into market sentiment and risk appetite.

If dominance is going up, it might mean people are being cautious and sticking with Bitcoin.

If dominance is going down, it could be a sign that altcoins are booming and people are taking more risks.

Just remember: the Bitcoin Dominance Chart doesn’t show everything—it should be used alongside other data like price trends, news, and broader economic signals.

It is smart to look at other signs too, like price trends, news, and what’s happening in the world economy.

Read More:

FAQs: Bitcoin Dominance Chart

1.What happens when Bitcoin dominance goes up?

It usually means people are moving money into Bitcoin because they think it’s safer. They might be worried about altcoins or the market in general.

2.What’s “true” Bitcoin dominance?

That’s a version of the chart that tries to ignore stablecoins and dead coins. It gives a clearer picture of how much Bitcoin is used in the active market.

3.Does the Bitcoin price go up when dominance rises?

Not always. Sometimes Bitcoin dominance rises just because altcoins are falling faster. But often, when Bitcoin outperforms altcoins, both the price and dominance go up.

4.Will Bitcoin go higher in the future?

No one knows for sure. Some people think Bitcoin will grow a lot because more companies and people are starting to use it. But prices can still go up and down based on news, rules, and the economy.

5.Who controls the Bitcoin chart?

No one person or group controls it. The chart just shows prices based on what’s happening in the market. It’s shaped by buyers, sellers, and global news