Metaplanet Pursues Digital Bank Acquisition to Scale Its Bitcoin Strategy

Metaplanet Accelerates Bitcoin Strategy with Digital Bank Acquisition Plans

Summary: Tokyo-listed Metaplanet has emerged as one of the largest corporate holders of Bitcoin, now controlling 15,555 BTC. CEO Simon Gerovich aims to expand that number to over 210,000 BTC by 2027—equivalent to 1% of all Bitcoin that will ever exist. The company is entering the next phase of its crypto strategy by leveraging its holdings to acquire cash-generating businesses, starting with digital banking.

Background: From Hedging to Heavy Accumulation

Metaplanet began purchasing Bitcoin in 2024 as a hedge against inflation. However, the company has since adopted a far more aggressive accumulation strategy. On Monday, the firm added 2,204 BTC for $237 million, bringing its total holdings to 15,555 BTC. This latest purchase was made at an average price of $108,600 per coin, increasing the firm’s average acquisition cost to approximately $99,985 per Bitcoin.

Metaplanet’s bold strategy has drawn investor attention, with shares surging 340% year-to-date despite modest underlying revenues.

Market Impact and Strategic Shift

Metaplanet has announced the transition to the second phase of its Bitcoin roadmap: using BTC as collateral to secure funding for acquisitions. One key target is a Japanese digital bank, allowing the company to enter the financial services sector and revamp outdated banking models.

Japanese microstrategy Metaplanet announced that its Bitcoin strategy has entered the second phase, planning to use BTC as collateral leverage to acquire cash flow businesses. Potential targets include Japanese digital banks, providing digital banking services that are better…

— Wu Blockchain (@WuBlockchain) July 8, 2025

This approach mirrors recent moves by global institutions like Standard Chartered and OKX, which have piloted crypto-backed loan programs. Metaplanet hopes to scale these efforts on a corporate level.

Competitive Landscape

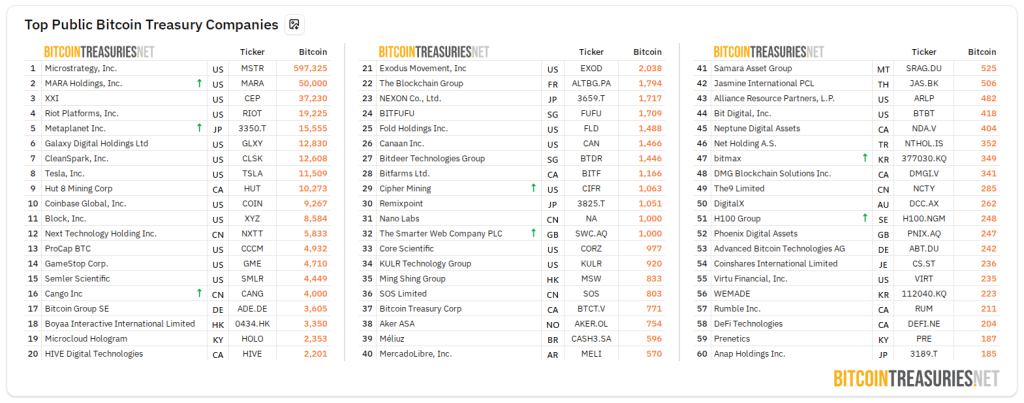

Metaplanet now ranks among the world’s top five corporate Bitcoin holders. For perspective, MicroStrategy leads with over 597,000 BTC and a market cap of $112 billion. Metaplanet’s market value currently exceeds $7 billion.

While both companies are long-term Bitcoin bulls, Metaplanet differs in its financing approach. CEO Simon Gerovich prefers issuing preferred shares over convertible debt to avoid risks linked to fluctuating stock prices and unpredictable repayments.

Risks and Regulatory Uncertainty

Using Bitcoin as loan collateral poses significant financial and operational risks. Lenders typically apply deep “haircuts” to volatile assets like BTC. Any price downturn could trigger margin calls, jeopardizing Metaplanet’s financial stability.

The regulatory framework in Japan for crypto-based lending remains somewhat ambiguous, adding further hurdles to the strategy. Moreover, transforming into a banking operator is a complex challenge. Metaplanet originally operated in the hospitality sector, and managing a digital bank demands entirely different competencies.

Outlook: Bold Moves in Uncharted Territory

Metaplanet’s Bitcoin-powered corporate model is both innovative and risky. If successful, it could redefine how companies use digital assets for capital formation and business expansion. If not, the Tokyo-based firm could face significant financial strain.

As it progresses with its digital banking ambitions, Metaplanet is likely to remain under close scrutiny from investors, crypto advocates, and financial regulators alike.

Featured image from Meta, charts via Bitcoinist and TradingView