Spot Bitcoin ETFs Add 1,430 BTC Daily As AUM Heads For 1.2M Mark – Analyst

Spot Bitcoin ETFs Accumulate 1,430 BTC Daily as AUM Approaches 1.2 Million Mark

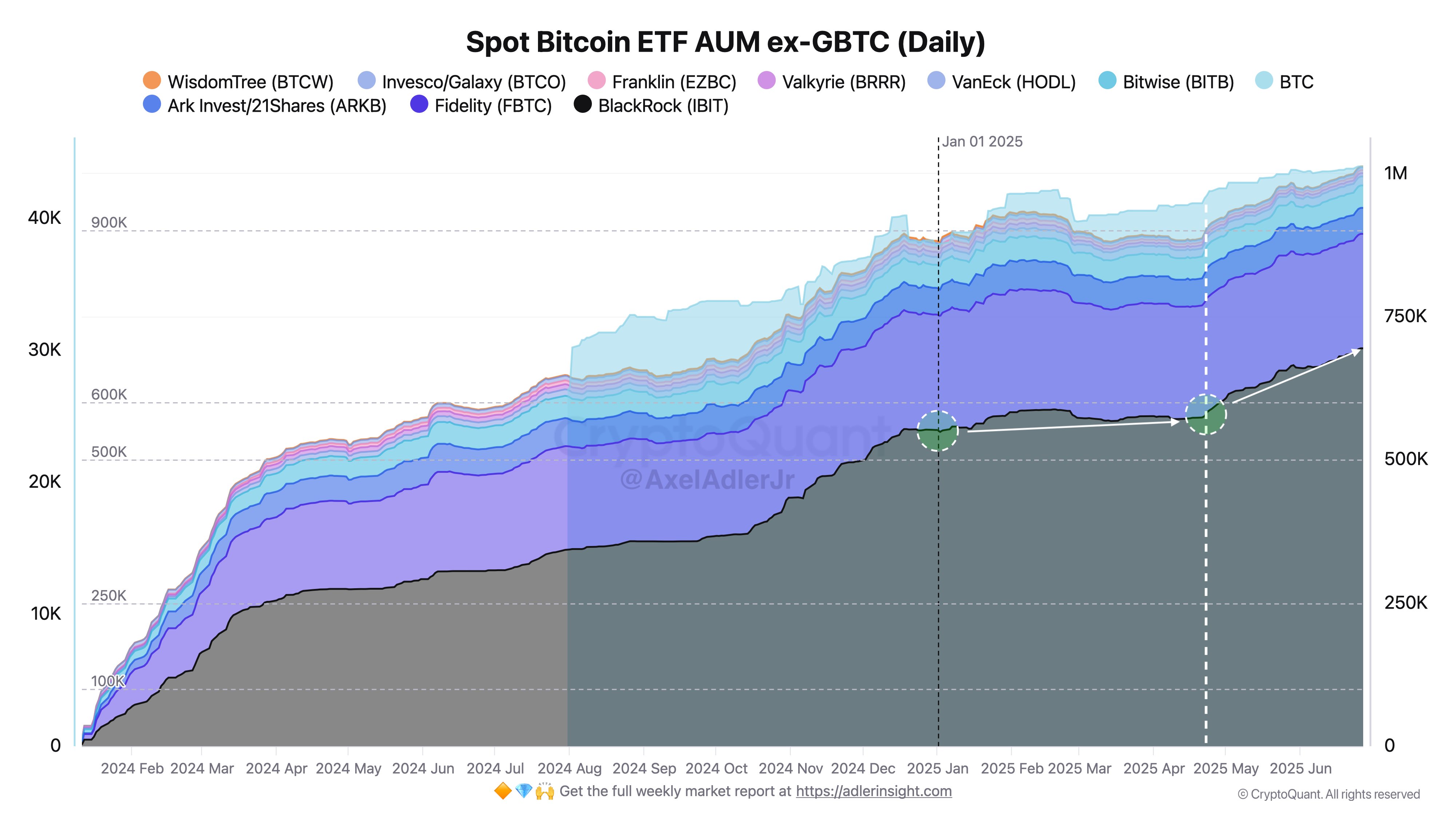

Summary: U.S. Spot Bitcoin ETFs are rapidly accumulating Bitcoin, with a current average daily net inflow of 1,430 BTC. Market analyst Axel Adler Jr. projects assets under management (AUM) could exceed 1.2 million BTC by September, further solidifying the ETFs’ role as key players in the ongoing crypto bull cycle.

Background: Institutional Growth in Bitcoin ETFs

Spot Bitcoin ETFs have emerged as major drivers of the current crypto market cycle, bringing substantial institutional capital into the Bitcoin ecosystem. Since their inception, U.S.-listed spot ETFs have acquired 6.25% of the Bitcoin market cap, reflecting strong demand and investor confidence in regulated crypto investment products.

ETFs on Track to Hit 1.2M BTC by September

According to a June 28 post by market analyst Axel Adler Jr., the combined AUM of U.S. Spot Bitcoin ETFs—excluding Grayscale’s GBTC—has grown from 932,000 BTC in April to 1,056,000 BTC. This represents a net increase of 124,000 BTC in just 87 trading days, averaging 1,430 BTC added per day.

Much of this growth is concentrated in BlackRock’s iShares Bitcoin Trust (IBIT), which alone accounted for 118,000 BTC—an average of 1,360 BTC per day. In contrast, the remaining 11 ETFs combined added only 6,000 BTC or 70 BTC per day over the same period.

Adler projects that, maintaining current inflow trends, total ETF holdings could reach 1.84 million BTC by September, representing approximately 9.25% of Bitcoin’s circulating supply. BlackRock IBIT is expected to hold around 817,000 BTC. Factoring in GBTC’s current asset value of $19.79 billion, total U.S. Spot ETF holdings could exceed $197.5 billion in BTC AUM.

Bitcoin Market Overview

Bitcoin is currently trading at $107,339, showing a modest 0.28% price increase over the last 24 hours. Daily trading volume has declined significantly, down 33.88% to $30 billion, indicating reduced short-term volatility.

On longer timeframes, BTC remains in positive territory with weekly and monthly gains of 5.61% and 1.06% respectively, suggesting renewed bullish momentum after a period of sideways action. However, Bitcoin continues to trade within a descending channel established since hitting a new all-time high of $111,970 in late May. Price currently fluctuates between the $100,000 and $110,000 range.