Bitcoin Funding Rates Continue To Decline — Short Squeeze Incoming?

Bitcoin Funding Rates Continue to Decline — Could a Short Squeeze Be Imminent?

Summary: Bitcoin has rebounded strongly over the past week, surging above $108,000 after briefly dipping below $100,000. Despite this recovery, declining funding rates suggest traders are increasingly betting against the rally—potentially setting the stage for a short squeeze.

Background: Trader Sentiment Diverges From Price Action

Bitcoin’s recent price performance has shown strong resilience, recovering from a sharp decline to breach the $108,000 mark. However, on-chain data suggests that sentiment among derivatives traders tells a different story. According to Glassnode, market participants remain wary of sustained upward momentum, as reflected in the declining funding rates and futures premiums across major exchanges.

Market Indicators Point to Bearish Positioning

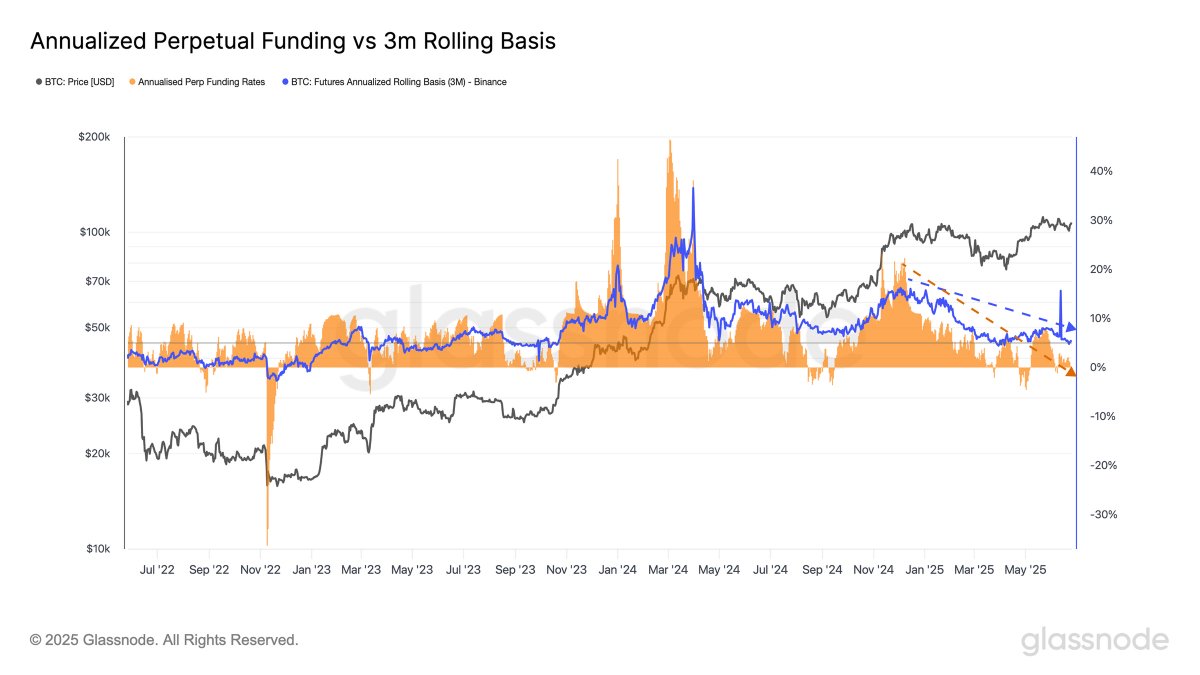

In a post shared on June 27 via X (formerly Twitter), analytics firm Glassnode highlighted the sustained decline in two key metrics: Annualized Perpetual (Perp) Funding Rates and Binance 3-Month (3M) Futures Annualized Rolling Basis.

The Perp Funding Rate measures the cost of holding long or short positions in Bitcoin’s perpetual futures market. A positive rate indicates dominance of bullish sentiment, where long traders pay short traders. Conversely, declining or negative rates imply increasing bearish positioning.

The 3M Futures Annualized Rolling Basis reflects the premium between spot prices and futures contracts expiring in three months. A narrowing or negative basis implies cautious or bearish positioning by traders.

As illustrated above, both metrics have trended downward since November 2023. Glassnode noted, “Despite high futures activity, appetite for long exposure is fading, reflecting increased caution and possibly more neutral or short-side positioning.”

Potential for a Short Squeeze

The persistence of negative funding rates indicates an accumulation of short positions in the market. Against a backdrop of rising institutional investment—particularly into U.S.-based Bitcoin ETFs—combined with supportive macroeconomic conditions, market analysts suggest a short squeeze may be on the horizon. This scenario could unfold if adverse price movements force short sellers to buy back BTC, driving prices even higher.

Bitcoin Price Update

At the time of writing, Bitcoin (BTC) is trading at approximately $107,180, recording minimal movement over the last 24 hours.